Special Report: Perjury and perfidy at the New York Armory

Three years ago this month, New York trackos were shocked to learn that Ed Small had left his longtime job as director of track and field at the Armory, an indoor track mecca in Manhattan. Shock turned to outrage when word spread that Ed didn’t merely retire. He was fired. I took an interest in his case since he coached Sharon Warren, a masters sprinter and Armory assistant. And Sharon was fired a few weeks after Ed. But Sharon and Ed fought back by suing the Armory, and early in 2008 they reached a settlement with Dr. Norbert Sander and The Armory Foundation, the 501(c)(3) nonprofit behind the track. The dollar amount wasn’t disclosed, but the settlement’s existence was. (See the N.Y. Division of Human Rights memo here.) Yet the case has loose ends — possibly felonious ones. In late 2006, The Armory Foundation filed a Form 990 with the IRS detailing its finances in 2005. Dr. Sander signed the document “under penalties of perjury.” But his Form 990 contains several lies. And I don’t know why.

Dr. Norbert Sander stands accused of felony perjury in his IRS filing of 2006.

So I wrote Dr. Sander, who runs the Armory, last Tuesday (May 5). I CC’d the email note to Derrick Adkins, the 1996 Olympic 400-meter hurdles champ who succeeded Ed Small as director of track and field at the Armory. Also informed were several other Armory execs and the gentleman who prepared the Form 990 for Loeb and Troper.

Here’s what I sent:

—–Original Message—–

From: trackceo@aol.com

To: nsander@armorytrack.com

Cc: Derrick@armorytrack.com; tim@armorytrack.com; thealy@armorytrack.com; mfrankfurt@fkks.com; jblatt@loebandtroper.com; dadest@loebandtroper.com

Sent: Tue, 5 May 2009 4:36 pm

Subject: Questions about Armory Foundation’s 2005 Form 990Greetings, Dr. Sander

I’m preparing a report on my blog about The Armory Foundation’s Form 990 filing from tax year 2005.

On page 9 of this filing (attached), you list Derrick Adkins as director of track and field for 2005, with a compensation of $55,000. But Mr. Adkins did not start work at the Armory until summer 2006, after Ed Small was fired as director of track and field.

Please reference your summer 2006 announcement:

http://www.armorytrack.com/ArmoryNews/Adkins.htmHere is my report on Ed’s firing:

http://masterstrack.com/blog/003700.htmlAlso on page 9, you list Tim Fulton as webmaster and Tom Healy as “security” — with compensations of $55,000 — even though both gentlemen began work at the Armory in fall 2005, according to a source.

My version of the Form 990 was downloaded from guidestar.org. It is signed by Joseph Blatt of your tax-preparer Loeb and Troper.

Would you please review your 2005 filing and kindly let me know how these discrepancies occurred?

Thanks very much for your attention.

Ken Stone

http://www.masterstrack.com

How did I know the Armory’s Form 990 (a public record) contained falsehoods?

I received a copy of the Form 990 in the mail a couple weeks ago — postmarked New York but lacking a return address — along with a photocopy of an invitation to report federal fraud for a possible reward.

According to federalfraud.com (a law firm that specializes in big-money graft cases):

Under federal law, if you have personal knowledge that an individual, business, city, county or town has provided false information to obtain money from the federal government, you may file a claim to recover more than TRIPLE the amount of monies defrauded from the government. If you do, you may become entitled to receive between 15% and 30% of the monies recovered by the federal government, as a reward.

That got my attention. But it turns out that reporting perjury on IRS forms doesn’t rate a reward if the government loses less than $2 million.

Still, perjury is a felony. And penalties for lying on IRS forms range up to $5,000 and a prison term of three years. People have done time for this. Yet smart lawyers advise their clients not to say squat to IRS agents. Check out this site, which talks about how the IRS deals with perjurers.

So it’s no wonder that Dr. Sander — who replied to my queries in past years — has been silent as a lamb in this case. Neither he nor the others I’ve CC’d have answered my latest note. Maybe they’ll talk when the Commissioner for Tax Exempt Organizations pays a visit.

Why would the Armory Foundation say Adkins was track director when he wasn’t? How could this have helped the Armory, saved it embarrassment or improved its financial status?

A simple oversight? Then why not file a corrected form?

Sometime in 2009, we’ll probably learn what the Armory paid Ed Small (and Sharon Warren) in their lawsuit settlement. Guidestar.org and other sites will post the Armory’s Form 990 for tax year 2008, when the settlement was paid. Should be in the form. Should be interesting.

For now, the big question remains: Why the lies?

The person who tipped me off to this mess remains a mystery. But the reason behind the anonymous mailing is perfectly clear: a wish to see justice done. Of course, in an age of monster Madoff ripoffs and KBR corruption, a little white lie on a tax form is incredibly trivial.

But we count on charities to tell the truth, and we expect them to treat their employees with fairness and dignity.

If you think this doesn’t matter, just ask Ed Small.

Derrick was a Columbia University assistant track coach

in 2005, and didn’t work for the Armory until summer 2006.

Dr. Sander signed this return well after April 15, 2006,

because he had applied for an extension.

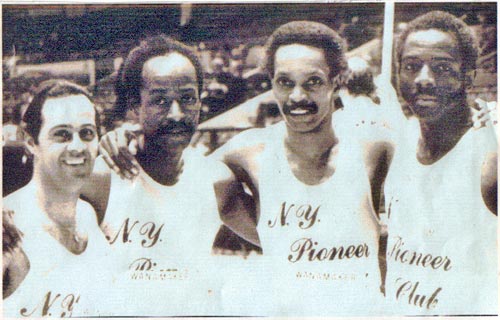

Ed Small (second from left) ran a masters relay at the Millrose Games in 1982.

Ed Small’s concluding accusations in his June 2006 complaint.

2 Responses

Any follow up on this? There may be more behind this if someone dug a little deeper.

yes i know a lot

the is deeper than deep

Leave a Reply